Our Lending Philosophy

As traditional financing regulation continues to become increasingly rigid, more borrowers are looking for alternative lending solutions to meet their financial needs.

Historically, borrowers that opted to go the private lending route have been viewed as high risk, and hence, they were denied credit and regularly fell victim to predatory lending practices. However, the growth of the private lending arena has proven that this is not always the case.

This gap in traditional mortgage financing has created a market for investors looking to capitalize on a growing alternative investment avenue. Through private lending, investors are able to preserve their capital while generating recurring and secured passive income, with returns outperforming other asset classes with similar risk profiles.

Nonetheless, like any investment, private lending does come with its considerations. Lenders must understand the fundamental characteristics of the real estate market, as well as the inherent risk of mortgage financing.

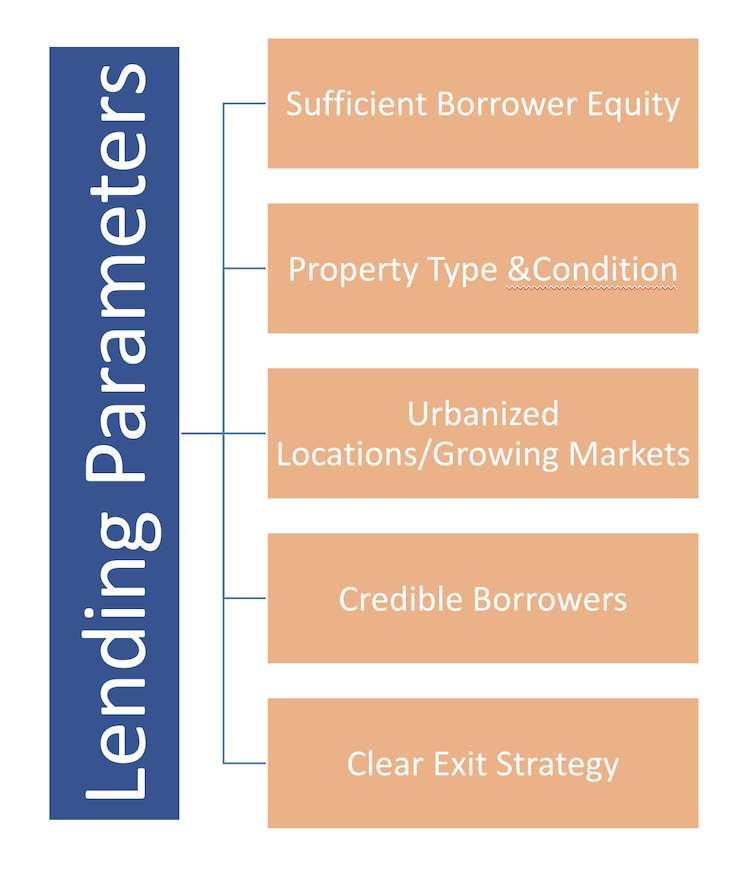

Capitis employs a common-sense lending approach based on specific lending criteria.